Mastering financial decisions requires specialized expertise.

Are you passionate about numbers and aspire to assist individuals and industries in managing their finances effectively? Accounting might be the ideal path for you!

Pursuing an accounting degree equips you to navigate crucial financial decisions, maintain meticulous financial records, and ensure precision in numerical data. This accounting degree program delves into how businesses and individuals leverage accounting principles to administer funds, evaluate outcomes, strategize for the future, and drive successful ventures.

Throughout this journey, you'll cultivate essential knowledge and skills, laying the foundation for a career that creates an impact - whether you aspire to a certified public accounting path or another area within the accounting, finance or other field.

By the Numbers

$83,980

$37/hr

16:1

1 in 5

Programs & Requirements

* The credit hours listed on this page only reference the specific program requirements and is not reflective of the total hours necessary to receive your degree. Cumberlands requires all students obtain a minimum of 60 hours for an associate’s degree and a total of 120 hours for a bachelor’s degree. Transfer and prior learning credits may be counted toward those totals.

To learn more about our General Education Requirements, please visit the page referenced below or explore our Academic Catalog.

Bachelor of Science in Accounting

The Hutton School of Business at University of the Cumberlands offers one of the nation’s best bachelor’s accounting degrees. In the Bachelor of Science (BS) program, you’ll take 66 credits of career-focused accounting coursework in addition to general education courses.

As you pursue your bachelor’s degree in accounting, you’ll study with faculty members who are actively involved in the business community as financial advisors, tax consultants, public accountants, officers of professional organizations, and members of corporate boards of directors. Small class sizes keep every study session personal and relevant. You can also gain practical work experience and earn 3-15 credit hours through corporate internships.

Course Requirements

- BACC 331 - Intermediate Accounting I

- BACC 332 - Intermediate Accounting II

- BACC 337 - Accounting Information Systems

- BACC 410 - Accounting Law & Ethics

- BACC 431 - Cost Accounting I

- BACC 433 - Advanced Accounting

- BACC 435 - Accounting Theory

- BACC 436 - Governmental Accounting

- BACC 437 - Federal Taxation

- BACC 438 - Taxation of Business Entities

- BACC 439 - Auditing

A Bachelor of Arts degree requires completing the same courses as a Bachelor of Science with the addition of completing one foreign language sequence through the intermediate level.

- FREN 131 Elementary French I

- FREN 132 Elementary French II

- FREN 231 Intermediate French I

- FREN 232 Intermediate French II

- SPAN 131 Elementary Spanish I

- SPAN 132 Elementary Spanish II

- SPAN 231 Intermediate Spanish I

- SPAN 232 Intermediate Spanish II

Minor in Accounting

Every business major can benefit from a minor in accounting. After all, no matter what career you pursue, money matters, so learn best how to manage it. If you want to pursue another passion as your full major but would like some insight into the financial world, this minor in accounting is for you.

Online Bachelor of Applied Science in Accounting

The Hutton School of Business at University of the Cumberlands offers one of the nation’s best bachelor’s degrees in accounting. In the Online Bachelor of Applied Science program, you’ll take 66 credits of career-focused accounting coursework in addition to general education courses.

As you pursue your applied science degree in accounting, you’ll study online with faculty members who are actively involved in the business community as financial advisors, tax consultants, officers of professional organizations, and members of corporate boards of directors. The ability to do your studying online gives you lots of flexibility in your busy schedule.

Course Requirements

- BACC 331 - Intermediate Accounting I

- BACC 332 - Intermediate Accounting II

- BACC 337 - Accounting Information Systems

- BACC 431 - Cost Accounting I

- BACC 433 - Advanced Accounting

- BACC 435 - Accounting Theory

- BACC 436 - Governmental Accounting

- BACC 437 - Federal Taxation

- BACC 438 - Taxation of Business Entities

- BACC 439 - Auditing

- BACC 410 - Accounting Law & Ethics

Online Associate of Science in Accounting

An online associate degree in accounting blends coursework in accounting and business to best position you to apply your expertise in organizational settings. Build from fundamental topics in accounting to intermediate-level insights in specialized area - managerial accounting, financial accounting and much more. A broad introduction to business principles rounds out your curriculum. Choose from an AA or AAS degree path to target your learning and career goals.

Online Associate of Applied Science in Accounting

An online associate degree in accounting blends coursework in accounting and business to best position you to apply your expertise in organizational settings. Build from fundamental topics in accounting to intermediate-level insights in this area. A broad introduction to business principles rounds out your curriculum. Choose from an AA or AAS degree path to target your learning and career goals.

Take the Next Step

Mission & Goals

The Hutton School of Business provides student-focused instruction and develops leadership skills. In addition to becoming well-versed in lifelong learning skills, ensuring they are always able to stay ahead of the curve, students will be prepared to:

Accounting Careers & Outcomes

All stats from the U.S. Bureau of Labor and Statistics

Government Accountant: $64,090

Government Accountant: $64,090

Government accountants maintain and examine the records of government agencies. They also audit private businesses and individuals whose activities are under taxation or regulation by the government. Federal, state, and local government accountants ensure money is received and spent according to laws and regulations. Their responsibilities include auditing, financial reporting, and management accounting.

Management Accountant: $62,200

Management Accountant: $62,200

Management accountants combine accounting and financial information to guide decision making for businesses. They also understand financial and non-financial data and how to integrate information. Management accountants work with information intended for internal use by business managers, not for the public.

Public Accountant: $76,820

Public Accountant: $76,820

Public accountants have a range of different accounting, auditing, tax, and consulting tasks. Their clients include corporations, governments, individuals, and nonprofits.

External Auditor: $58,038

External Auditor: $58,038

External auditors make sure that organizations are properly managing funds, revenue, and financial data, and managing risks. They are employed by an outside organization rather than the one they are auditing.

IT Auditor: $68,090

IT Auditor: $68,090

IT Auditors look at an organization’s IT systems to ensure that both financial and nonfinancial data come from a reliable source.

Internal Auditor: $77,772

Internal Auditor: $77,772

Internal auditors’ duties are similar to those of external auditors, but internal auditors are employed by the organization they are auditing. They find ways to improve the processes for eliminating waste, fraud, and other financial risks to the organization.

Common Questions

The field of finance focuses on planning and directing financial activities, while accounting is all about identifying and recording the results of these activities.

With an accounting degree, many graduates go on to become accountants and auditors. These professionals prepare and review financial records, identifying areas of risk and opportunity. You could also consider a financial examiner career path. Examiners monitor banks and other financial institutions to ensure they comply with laws that protect consumers.

For many students, earning a bachelor’s in accounting from an accredited school is a worthwhile investment for the job opportunities, the higher salary, and the rewarding career it can provide.

Some “hard skills” you’ll need are the ability to use spreadsheet software, memorization of different formulas to use in sheets to streamline your work, and knowledge of the tax laws for whatever state(s) in which your client resides or owns businesses. Necessary “soft skills” include problem solving, keeping track of many details and numbers, organization, and good communication.

Regardless of what career you choose, an accounting degree at Cumberlands will teach you better organization, how to interpret data, strong communication skills, critical thinking, good business ethics, and more. These skills will benefit you in any and every field.

Costs for programs of study at University of the Cumberlands are competitive and affordable. Click here to view tuition rates and fees. (LINK: one price promise information)

Faculty Experts

Learn more about the professors you will interact with and view the list of the accounting faculty.

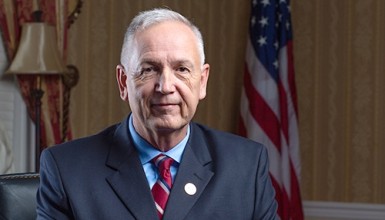

Raymond McGhee

Raymond McGhee

Contact Information

Margaret Combs

Margaret Combs

Contact Information

Dr. Jake Brock

Program Accreditation

The Hutton School of Business at University of the Cumberlands has received specialized accreditations for its business programs through the International Accreditation Council for Business Education (IACBE) located at 11960 Quivira Road in Overland Park, Kansas, USA. For a list of accredited programs please refer to our IACBE member status page

Please review our Public Disclosure of Student Achievement.

Request Information

Make sure all your information is adding up. Ask us your questions, and we'll send you answers soon!