Mastering financial decisions requires specialized expertise.

Are you passionate about numbers and aspire to assist individuals and industries in managing their finances effectively? Accounting might be the ideal path for you!

Pursuing an accounting degree equips you to navigate crucial financial decisions, maintain meticulous financial records, and ensure precision in numerical data. This accounting degree program delves into how businesses and individuals leverage accounting principles to administer funds, evaluate outcomes, strategize for the future, and drive successful ventures.

Throughout this journey, you'll cultivate essential knowledge and skills, laying the foundation for a career that creates an impact - whether you aspire to a certified public accounting path or another area within the accounting, finance or other field.

By the Numbers

$83,980

$37/hr

16:1

1 in 5

Programs & Requirements

* The credit hours listed on this page only reference the specific program requirements and is not reflective of the total hours necessary to receive your degree. Cumberlands requires all students obtain a minimum of 60 hours for an associate’s degree and a total of 120 hours for a bachelor’s degree. Transfer and prior learning credits may be counted toward those totals.

To learn more about our General Education Requirements, please visit the page referenced below or explore our Academic Catalog.

Bachelor of Science in Accounting

The Hutton School of Business at University of the Cumberlands offers one of the nation’s best bachelor’s accounting degrees. In the Bachelor of Science (BS) program, you’ll take 66 credits of career-focused accounting coursework in addition to general education courses.

As you pursue your bachelor’s degree in accounting, you’ll study with faculty members who are actively involved in the business community as financial advisors, tax consultants, public accountants, officers of professional organizations, and members of corporate boards of directors. Small class sizes keep every study session personal and relevant. You can also gain practical work experience and earn 3-15 credit hours through corporate internships.

Course Requirements

- BACC 331 - Intermediate Accounting I

- BACC 332 - Intermediate Accounting II

- BACC 337 - Accounting Information Systems

- BACC 410 - Accounting Law & Ethics

- BACC 431 - Cost Accounting I

- BACC 433 - Advanced Accounting

- BACC 435 - Accounting Theory

- BACC 436 - Governmental Accounting

- BACC 437 - Federal Taxation

- BACC 438 - Taxation of Business Entities

- BACC 439 - Auditing

A Bachelor of Arts degree requires completing the same courses as a Bachelor of Science with the addition of completing one foreign language sequence through the intermediate level.

- FREN 131 Elementary French I

- FREN 132 Elementary French II

- FREN 231 Intermediate French I

- FREN 232 Intermediate French II

- SPAN 131 Elementary Spanish I

- SPAN 132 Elementary Spanish II

- SPAN 231 Intermediate Spanish I

- SPAN 232 Intermediate Spanish II

Minor in Accounting

Every business major can benefit from a minor in accounting. After all, no matter what career you pursue, money matters, so learn best how to manage it. If you want to pursue another passion as your full major but would like some insight into the financial world, this minor in accounting is for you.

Associate of Science in Accounting

An online associate degree in accounting blends coursework in accounting and business to best position you to apply your expertise in organizational settings. Build from fundamental topics in accounting to intermediate-level insights in specialized area - managerial accounting, financial accounting and much more. A broad introduction to business principles rounds out your curriculum. Choose from an AA or AAS degree path to target your learning and career goals.

Take the Next Step

Mission & Goals

The Hutton School of Business provides student-focused instruction and develops leadership skills. In addition to becoming well-versed in lifelong learning skills, ensuring they are always able to stay ahead of the curve, students will be prepared to:

Accounting Careers & Outcomes

All stats from the U.S. Bureau of Labor and Statistics

Government Accountant: $64,090

Government Accountant: $64,090

Government accountants maintain and examine the records of government agencies. They also audit private businesses and individuals whose activities are under taxation or regulation by the government. Federal, state, and local government accountants ensure money is received and spent according to laws and regulations. Their responsibilities include auditing, financial reporting, and management accounting.

Management Accountant: $62,200

Management Accountant: $62,200

Management accountants combine accounting and financial information to guide decision making for businesses. They also understand financial and non-financial data and how to integrate information. Management accountants work with information intended for internal use by business managers, not for the public.

Public Accountant: $76,820

Public Accountant: $76,820

Public accountants have a range of different accounting, auditing, tax, and consulting tasks. Their clients include corporations, governments, individuals, and nonprofits.

External Auditor: $58,038

External Auditor: $58,038

External auditors make sure that organizations are properly managing funds, revenue, and financial data, and managing risks. They are employed by an outside organization rather than the one they are auditing.

IT Auditor: $68,090

IT Auditor: $68,090

IT Auditors look at an organization’s IT systems to ensure that both financial and nonfinancial data come from a reliable source.

Internal Auditor: $77,772

Internal Auditor: $77,772

Internal auditors’ duties are similar to those of external auditors, but internal auditors are employed by the organization they are auditing. They find ways to improve the processes for eliminating waste, fraud, and other financial risks to the organization.

Common Questions

An accounting degree focuses on understanding and managing financial records for businesses or individuals. It covers principles like auditing, taxation, financial reporting, and management accounting, preparing students for various careers in finance, auditing, and bookkeeping.

An associate degree in accounting typically takes two years, while a bachelor’s degree takes about four years to complete. Both programs require general education courses and specialized accounting coursework.

Yes, many institutions offer online accounting degree programs, allowing students to earn their degree remotely while gaining the same foundational knowledge and skills required in the accounting field.

An accounting degree can be a valuable investment, providing strong career prospects in a growing field. With roles like accountant, auditor, or financial analyst, the demand for accounting professionals remains steady, and earning potential is generally favorable.

With an accounting degree, you can pursue careers such as public accountant, management accountant, government accountant, auditor, or financial analyst. These roles involve managing financial data, auditing, tax preparation, and providing financial insights to guide business decisions.

To get an accounting degree, enroll in an accredited program at a college or university. You can pursue an associate or bachelor’s degree, depending on your career goals. Complete the required coursework, which typically includes topics like financial accounting, auditing, and taxation.

The best degree for accounting is typically a Bachelor of Science (BS) in Accounting or a Bachelor of Business Administration (BBA) with a focus on accounting. These programs provide the necessary foundation for various accounting roles.

Accounting is usually offered as a Bachelor of Science (BS) or a Bachelor of Business Administration (BBA). Some schools may offer a Bachelor of Arts (BA) in Accounting, but the BS or BBA is more common and focuses more on technical skills.

Yes, you can become an accountant without a finance degree. A degree in accounting is typically preferred, but other degrees in related fields, such as business administration, can also lead to accounting roles with additional certification or experience.

To become a Certified Public Accountant (CPA), you typically need an accounting degree or a degree with a concentration in accounting. You must also meet the specific educational and experience requirements of your state and pass the CPA exam.

Faculty Experts

Learn more about the professors you will interact with and view the list of the accounting faculty.

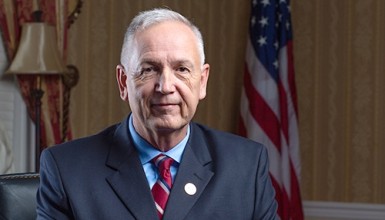

Dr. Joseph Krupka

Raymond McGhee

Raymond McGhee

Contact Information

Margaret Combs

Margaret Combs

Contact Information

Program Accreditation

The Hutton School of Business at University of the Cumberlands has received specialized accreditations for its business programs through the International Accreditation Council for Business Education (IACBE) located at 11960 Quivira Road in Overland Park, Kansas, USA. For a list of accredited programs please refer to our IACBE member status page

Please review our Public Disclosure of Student Achievement.

Request Information

Make sure all your information is adding up. Ask us your questions, and we'll send you answers soon!